Bankruptcy Lawyer, Bridgeport CT

The stress of debt can be debilitating, causing you to feel shame and embarrassment, consuming your every thought, following you around like a shadow. At times, it may feel like you’ll never experience the relief of being debt-free or see the sunshine again. If you’ve ever felt this way, or are concerned about paying off your debt, you need to talk to a bankruptcy lawyer in Bridgeport, CT at the Law Offices at Ronald I. Chorches. Deciding to file for bankruptcy is not an easy decision. However, choosing the right law firm to guide you through the process can be.

Is Bankruptcy Right for Me?

Have you fallen on hard financial times and found yourself unable to pay back creditors? Each month you’re falling further behind on bills, having to incur more debt to just “get by”? Financial struggles are not easy, nor are the decisions we make regarding our finances. Personal debt can take many forms. Although filing for bankruptcy may not alleviate all of your financial burdens, it can help with the following types of debt:

- Personal Loans

- Credit Cards

- Medical Bills

- Overdue Utility Payments

However, certain types of debt may not be covered by filing for bankruptcy:

- Child Support

- Alimony

- Most Taxes

- Most Student Loans

Trying to figure out which of these categories your unique situation falls under can be confusing and stressful. That is why discussing your financial hardships with a bankruptcy lawyer in Bridgeport, CT may be the best way to make sense of your options.

How Will My Credit be Affected?

Many people fear their credit will be ruined after filing for bankruptcy. They are concerned about the impact it may have on their dreams of buying a house or paying for their child’s college education. Though bankruptcy proceedings will impact your credit score and appear on your credit history for several years, the financial freedom may outweigh potential challenges. That is why having a bankruptcy lawyer who understands the intricacies of bankruptcy law is an invaluable resource. Having a better understanding of how filing for bankruptcy can affect your credit will allow you to make a more informed decision.

Types of Bankruptcy

There are several types of bankruptcy. Having a professional who understands the nuances and regulations of each one will help you decide which one best suits your needs. Wading through the myriad of regulations can cause added stress to an already stressful situation. You may feel confused and wonder what your eligibility is based on your special circumstances.

Seeking professional help from a bankruptcy lawyer can help set you on the path to a better financial future. It can be a daunting process, but with the help of a bankruptcy lawyer in Bridgeport, CT at the Law Offices at Ronald I. Chorches, you may finally find yourself out of debt shadow and working towards your financial goals.

Debt can pile up slowly over time or all at once. Either way, it’s hard to prepare for what to do to handle it. It can feel like debt is taking over life and cause you to live in an almost constant state of stress. But that doesn’t have to be the case. Finding a Bridgeport, CT bankruptcy lawyer to assess your situation can help you understand your options to get out of debt and get a fresh start. The Law Offices of Ronald I. Chorches has an excellent team of attorneys that can help you. Call us today to set up a consultation to learn how you can get out from under your mountain of debt.

Every Situation Is Unique

There are many forms of debt relief that can help you reduce your debt such as bankruptcy, debt settlement, and debt consolidation. Understanding which form of debt relief will benefit you the most is hard to do without sound legal advice from a lawyer. Bankruptcy lawyers know the nuances of the legal system. They will request financial documents and ask you questions about your past and current circumstances. They will also want to understand your future plans and goals. Based on this evaluation they will advise you on what your best options are so you can make an informed decision.

Different Types of Bankruptcy

If you have weighed your options and are considering bankruptcy, it is important to know that there are two different types. A knowledgeable bankruptcy lawyer in Bridgeport, CT from a firm like The Law Offices of Ronald I. Chorches can explain the differences between Chapter 7 and 13 bankruptcy in depth. In short, although there is some overlap, the two types of bankruptcy cover different forms of debt and the course of action for them are different.

Chapter 7 Bankruptcy

If you choose to file for Chapter 7 Bankruptcy in Connecticut, you are filing to have a trustee liquidate all of your assets, except for those that fall under an exemption. The money from this liquidation pays off your debt, and a portion of it returns to you. It’s akin to giving you a fresh start.

Chapter 13 Bankruptcy

Chapter 13 Bankruptcy is quite different from Chapter 7 Bankruptcy. Whereas Chapter 7 is about helping you to start over, Chapter 13 adheres to a separate process from liquidating your assets. In this case, a debtor negotiates a three to five-year repayment plan between you and your creditors. You promise to pay off your debts with future income. Thus, you’d have to show a future plan to make enough income that will satisfy your debts. A skilled bankruptcy lawyer in Bridgeport CT can help you accomplish this end.

Other Types of Bankruptcy

Chapter 9 – This type of bankruptcy is used by municipalities. It may include towns, cities, school districts, and other similar types of entities. A repayment plan will be established that allows the entity to continue forward with its services and operations as normal. The repayment plan will need to ensure that the debts are repaid with favorable terms to creditors.

Chapter 11 – Chapter 11 bankruptcy is one that is used by businesses and companies typically. However, individuals can also file for this bankruptcy type if their circumstances don’t qualify them for chapter 7 or chapter 13. Under chapter 11 bankruptcy an organization or large business will need to restructure its finances in order to pay back creditors. Under this plan, they can continue their operations even though they are in debt.

Chapter 12 – A Chapter 12 bankruptcy is set up for farmers or fishermen to stay in business even though they are in debt. They are not required to liquidate and will be put on a repayment plan. To learn more about the terms of this bankruptcy be sure to contact The Law Offices of Ronald I. Chorches to speak with an experienced Bridgeport, CT bankruptcy lawyer.

Chapter 15 – This type of bankruptcy is for international cases and is the newest type of bankruptcy. There are only about 200 cases per year where this bankruptcy is used in the United States but the rates are growing each year. A Chapter 15 bankruptcy can be filed when a business or individual has assets in more than one country including the United States. Your bankruptcy lawyer in Bridgeport, CT from The Law Offices of Ronald I. Chorches can fill you in more on the details.

Terms of a Bankruptcy

Terms of bankruptcy typically need to be favorable to creditors for them to be able to recoup their loaned out money from debtors. This is why it can become tricky for those in debt to come up with favorable ways for them to pay off their loans. Businesses and individuals often feel overwhelmed by the reality that they are facing. While there is a breath of fresh air that bankruptcy can be filed for to finally bring an end to the tormenting debt the actions that take place next can be difficult. Individuals may be required to sell off their own homes to pay back debts. They also may have to sell off other assets.

Repayment plans may see someone spending a large amount of their monthly income to pay back debts. Businesses may see huge portions of their profits going to pay back creditors and may even find themselves making the same mistakes they made before when it comes to finances. For assistance with bankruptcy-related issues, reach out to a bankruptcy lawyer in Bridgeport, CT from The Law Offices of Ronald I. Chorches. We can assist you with your bankruptcy issues and bring about more favorable terms to your repayment plan. We can help save certain assets that you don’t wish to be sold.

Can I File More Than Once?

You may file for bankruptcy as many times your lifestyle requires it. There is no maximum amount.

How Will Filing Affect My Child Support Payments?

As previously mentioned, filing for bankruptcy does not impact all types of debt. Child support is one of those debts. Whether you are current or in arrears paying child support, you must pay child support until your child reaches the age of majority, which is eighteen years old. It is against the law to not pay child support, as this financial aid is your legal obligation as a parent. Failure to render this financial aid may result in a judge holding you in contempt of court. This means that a judge may issue a warrant for your arrest. Yes, you may be ordered to spend time in county jail, or even lose your driving privileges, if you owe child support.

Bear in mind that child support money is separate from spousal support.

Now that you’re aware of this, your next question might be, “If I file for bankruptcy, can my child support payment amounts be reduced, at least?” Yes. There is a possibility that a judge will reduce your child support payments. A judge can reduce your monthly assistance if there has been a significant change in your income, ability, or other aspect of your life. For example, fathering or mothering five more children may be considered a significant change because your money has to be spread more thinly. Likewise, filing for bankruptcy is bound to be considered a significant change because it shows that you are having severe financial hardship.

How Will Filing Affect My Spousal Support Payments?

In Connecticut, spousal support is not a requirement of divorce, but most judges will grant your ex-spouse alimony if the circumstances suggest that it’s in your ex-spouse’s best interest. The number of years you’ll have to pay spousal support coincides with the number of years you were married. Filing for bankruptcy won’t terminate this court-order, but it can be cause for a judge to reduce the monthly amount you’ve been ordered to pay.

Weighing Whether You Should File for Bankruptcy

There are benefits and drawbacks to filing for bankruptcy. One of the biggest drawbacks is that it will negatively affect your credit score for a number of years after you file. It can make it hard to purchase a house, get a loan, or open a credit card account. On the other hand, if you are not able to pay off your debt anytime in the near future, bankruptcy can offer you a path forward.

People go into debt for lots of different reasons and it doesn’t make you a bad person. You don’t deserve to live in a perpetual state of stress. Reach out to the Law Offices of Ronald I. Chorches today to find a bankruptcy lawyer in Bridgeport, CT and begin the process of freeing yourself from debt.

Considering Bankruptcy? Evaluate Your Priorities Before You File

Filing for bankruptcy is a serious process with both short-term and long-term implications. Under no circumstance is it a venture that you want to take on without a reputable bankruptcy lawyer in Bridgeport, CT by your side. The experienced attorneys at the Law Offices of Ronald I. Chorches will advise you that your first priority is getting the creditors off of your back. Still, you want to do it while mitigating as much risk to yourself as possible. In order to do that, you need to have a basic understanding of the basic forms of bankruptcy, and the unique pros and cons they offer.

Time Vs. Assets

Once you’ve made the decision to file for bankruptcy, you have acknowledged that you’re ready to make some sacrifices. Still, a bankruptcy lawyer in Bridgeport, CT can help to soften the blow.

Bankruptcy proceedings can be done in two ways. The debtor can either sell their assets to satisfy their creditors, or they can enter into a court-supervised repayment plan. When you have your consultation with the Law Offices of Ronald I. Chorches, you’ll likely hear these referred to as liquidation or reorganization. With the help of your attorney, you will need to assess what is more important to you. Do you want to end the proceedings as quickly as possible, or do you want to get out with your assets intact? You’ll also need to consider which option is more compatible with your income.

Chapter 7, Chapter 11, and Chapter 13

For debtors who view expedience as a priority, Chapter 7 may prove to be advantageous. Chapter 7 is a liquidation filing that allows debtors to sell assets in order to generate the funds to pay their creditors. For this reason, Chapter 7 tends to resolve quickly. For households, individuals, or businesses who want to avoid liquidating their assets. Reorganization may prove to be the more effective method. Chapter 11 and Chapter 13 are both reorganization bankruptcies, but they come with different eligibility requirements and implications. Be sure to talk with your attorney in order to get the full picture.

With so many considerations, you need someone who knows the ins and outs on your side. The Law Offices of Ronald I. Chorches have what it takes to be advisors and advocates as you embark upon the journey of regaining control over your financial future. You sure to be glad that you made the call.

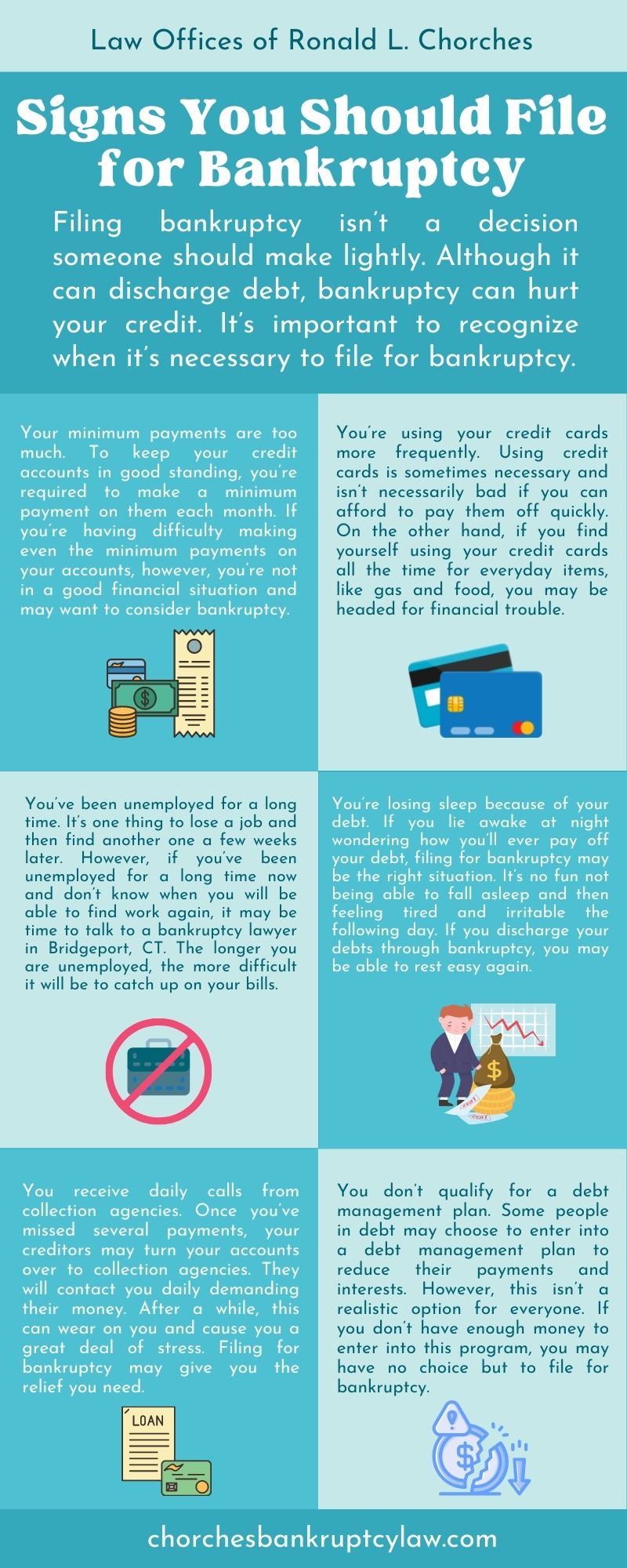

Signs You Should File for Bankruptcy

Filing bankruptcy isn’t a decision someone should make lightly. Although it can discharge debt, bankruptcy can hurt your credit. It’s important to recognize when it’s necessary to file for bankruptcy.

Your minimum payments are too much

To keep your credit accounts in good standing, you’re required to make a minimum payment on them each month. If you’re having difficulty making even the minimum payments on your accounts, however, you’re not in a good financial situation and may want to consider bankruptcy.

You’re using your credit cards more frequently

Using credit cards is sometimes necessary and isn’t necessarily bad if you can afford to pay them off quickly. On the other hand, if you find yourself using your credit cards all the time for everyday items, like gas and food, you may be headed for financial trouble.

You’ve been unemployed for a long time

It’s one thing to lose a job and then find another one a few weeks later. However, if you’ve been unemployed for a long time now and don’t know when you will be able to find work again, it may be time to talk to a bankruptcy lawyer in Bridgeport, CT. The longer you are unemployed, the more difficult it will be to catch up on your bills.

You’re losing sleep because of your debt

If you lie awake at night wondering how you’ll ever pay off your debt, filing for bankruptcy may be the right situation. It’s no fun not being able to fall asleep and then feeling tired and irritable the following day. If you discharge your debts through bankruptcy, you may be able to rest easy again.

You receive daily calls from collection agencies

Once you’ve missed several payments, your creditors may turn your accounts over to collection agencies. They will contact you daily demanding their money. After a while, this can wear on you and cause you a great deal of stress. Filing for bankruptcy may give you the relief you need.

You don’t qualify for a debt management plan

Some people in debt may choose to enter into a debt management plan to reduce their payments and interests. However, this isn’t a realistic option for everyone. If you don’t have enough money to enter into this program, you may have no choice but to file for bankruptcy.

To learn more, please call today!

We also service clients from Middletown, New Haven, and West Hartford.