Foreclosure Lawyer Hartford CT

If you’re facing foreclosure, consider speaking to a foreclosure lawyer in Hartford, CT from The Law Offices of Ronald I. Chorches. Foreclosure can be a scary ordeal, and you don’t want to go through it alone. Here are some benefits of hiring a foreclosure lawyer.

Assist in Modifying Your Loan

A loan modification refers to an agreement between the borrower and lender that modifies the initial terms of the loan. It may extend the length of the loan or lower the interest rate. A foreclosure can assess the loan modification and ensure it reflects your best interests.

Educate You About Alternative Options

When you’re in danger of foreclosure, you may be searching for all the alternative options available to you. However, your lender may not tell you about all of these alternatives. An experienced foreclosure lawyer, on the other hand, can. For example, your lawyer may inform you about a “partial claim,” which can bring you current on your mortgage payments.

Prevent Unethical Practices

If you’re behind on your mortgage payments, your lender may try to force you to leave your home as soon as possible. They may even engage in illegal practices to push you out. If you have a foreclosure lawyer on your side, he or she won’t let this happen. He or she will let you know how long you can remain in your home and make you aware of your rights.

How To Stay In Your Home Even if You Face Foreclosure

When you buy a home with the help of a mortgage loan, there is a false sense of security in thinking that the home is yours for good. The reality is that though your name is on the deed to your house, a large part of the home is owned by your mortgage lender. If you cannot pay your monthly rate, you will face foreclosure in quick succession. A foreclosure lawyer can help you minimize your loss of assets, and you may even be able to remain in your home.

The threat of foreclosure does not have to render you homeless. You can try the following things with the aid of the Law Offices of Ronald I. Chorches before you hand your house keys over for good.

Communicate With Your Lender

First, when you find yourself short on cash, your foreclosure lawyer will always advise you not to sacrifice your mortgage payment. If you cannot fit your monthly mortgage payment into your budget, don’t hide behind your bills. As stressful as this may seem, reach out to your mortgage lender.

Even if your lender won’t be flexible on your monthly payment, they may give you options and resources to help you become current on your mortgage. Those options may be tailored specifically to your situation; you might not be able to find them on the lenders’ general information brochures or website.

That said, communicating with your mortgage lender can be intimidating. Mortgage lenders are known to be less than forthcoming with their customers, especially if you aren’t accustomed to asking the right questions. Use a foreclosure lawyer as your legal representative and mediator to keep the lines of communication open with your mortgage lender.

Pay Partially When Possible

Even if you are a month or two behind on your mortgage payments, don’t feel pressured to become current with one lump sum. If you consult the Law Offices of Ronald I. Chorches, you will be advised to pay as much of the outstanding amount as you can. Your lawyer may arrange a special catch up plan with your lender to help make those payments more manageable.

Seek Out Little Known Resources

Your lender is not in the business of helping you stay in your home. Your loss is their profit. So they may not make you aware of all your available resources to save your home from foreclosure. For instance, your foreclosure lawyer might help you find grants for low income homeowners with disabilities if you qualify. You also have the right to ask for a mortgage modification from your lender if your financial statements reflect a hardship. In the case of a fixed income or a medical emergency, you may even qualify for subsidized mortgage payments or a deferment.

Questions To Ask a Foreclosure Lawyer

When dealing with foreclosure, consulting an attorney should be your first step. A foreclosure lawyer in Hartford, CT, can answer any questions you may have and assist you with the process. It is essential to ensure you are hiring the right person, so here are some questions you should ask first.

Do You Specialize In Foreclosures?

Having an experienced lawyer from the Law Offices of Ronald I. Chorches can be valuable when dealing with foreclosure. Many lawyers work in other areas, and you want to be sure the lawyer can handle your case and has the expertise to do so. If they have a lot of experience with foreclosures, you can know you are getting the best experience possible.

How Much Will You Charge?

Many lawyers charge hourly, though some charge a flat fee. Depending on your situation, one payment type may be better than the other. Ask your attorney what kind of payment arrangement they have in place. There may be a retainer fee if there is an hourly or monthly fee. You can learn more about the payment process from a foreclosure lawyer in Hartford, CT.

What Types of Foreclosures Have You Handled?

A foreclosure attorney has probably dealt with various situations, but you want to ensure they handle your case. It is valuable if you have a complicated or unusual case. Also, an attorney can let you know of any other options you may have that you were not aware of before. Hiring an experienced attorney is beneficial if they can tell you a different path that might not lead to foreclosure. If you can afford a lawyer, it is valuable to hire one.

How Will We Communicate?

Depending on the attorney, you may email or call each other regularly. Before hiring a lawyer, ask how often you both will communicate and how you will do so. Some lawyers may do a periodic check-in, while others will contact you weekly. You want to ensure your schedules and communication preferences line up and there are no issues. It is essential to know what to expect when it comes to communication.

What Do You Need From Me?

There will most likely be documents you need to sign and a retainer agreement. When hiring a foreclosure lawyer in Hartford, CT, from the Law Offices of Ronald I. Chorches, make sure you have access to any necessary paperwork to help the process go smoothly.

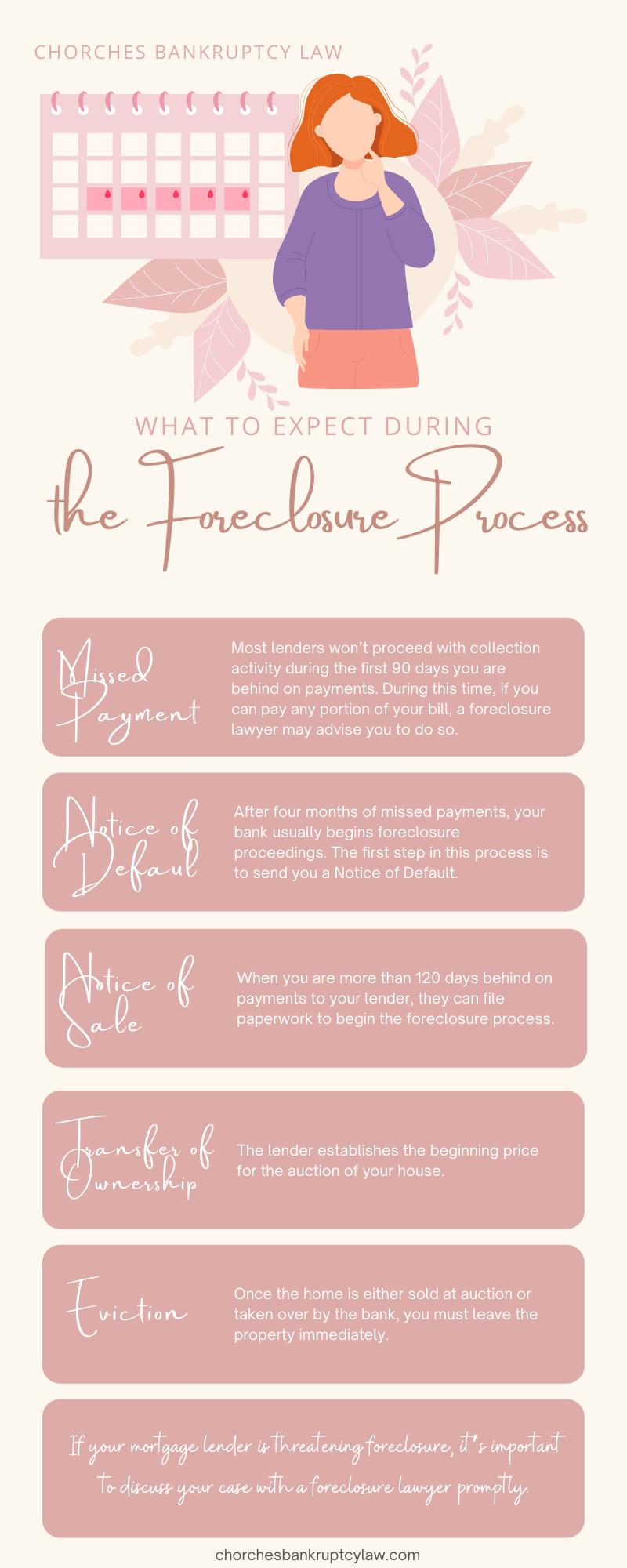

What To Expect During the Foreclosure Process

Missed Payments

Your mortgage payment is usually due on the first of the month. After 30 days of no remittance, your lender may reach out with a reminder letter or phone call, and your bank may charge a late fee. Most lenders won’t proceed with collection activity during the first 90 days you are behind on payments. During this time, if you can pay any portion of your bill, your CT foreclosure lawyer in Hartford may advise you to do so. After these 90 days, your bank sends a demand letter requiring you to bring all three months current within 30 days to avoid collection procedures.

Notice of Default

After four months of missed payments, your bank usually begins foreclosure proceedings. The first step in this process is to send you a Notice of Default. This official letter gives you an additional 30 days to get your loan caught up. Reach out to the Law Offices of Ronald I. Chorches for direction on proceeding if you receive a notice of default. A foreclosure lawyer can ensure your lender adheres to the federal regulations during this process.

Notice of Sale

When you are more than 120 days behind on payments to your lender, they can file paperwork to begin the foreclosure process. The lender’s attorney schedules the home for auction and files the notice of sale with the county. The auctioneer may organize the deal in as little as two to three months. A foreclosure lawyer may still be able to work with your lender to make payment arrangements before the auction.

Transfer of Ownership

The lender establishes the beginning price for the auction of your house. This amount is the minimum they hope to get from the sale, and the price should cover the loan, past due fees and any other taxes or liens owed to the bank. During the auction, the house goes to the highest bidder. If your home sells for more than the amount you owe the bank, a lawyer from the Law Offices of Ronald I. Chorches may be able to get the overages returned to you. If your home doesn’t sell at the auction, it becomes the property of the bank. The lender then lists the house for sale to recoup the money lost on your loan and legal fees.

Eviction

Once the home is either sold at auction or taken over by the bank, you must leave the property immediately. You may get a few days to remove your belongings before the authorities force you to leave.

Represent You in Court

If you have a good defense against foreclosure, it may be in your best interest to go to court. For example, if you’re an active military member, you may be entitled to protection against foreclosure. However, if you don’t have a legal background, it may be difficult to present a clear argument. That’s another reason why you should have a foreclosure lawyer standing next to you. He or she has experience defending people just like yourself in court and can help you get a dismissal.

Telling Your Spouse About Foreclosure

For many people, foreclosure is a weighted word that can be difficult to digest. To a property owner, this means their life may be turned completely upside down, and they will have to leave the place they call home. Depending on the situation, you may have been trying to fight a foreclosure without telling your spouse, hoping that you can resolve the issue and avoid having a tough conversation.

However, keeping it a secret can only cause more problems, especially if your partner has the capacity to help you. If you have been avoiding foreclosure for some time and haven’t told your partner yet, here are reasons why you should:

- By facing foreclosure, you are more vulnerable to being a victim of a rescue foreclosure scam. The scam may advertise that your partner never has to find out, and that they can resolve the situation quickly for you.

- The longer you keep it a secret (and take steps that don’t actually resolve the problem), there’s less time left to actually save your home, sell it, or look into other options.

- As a couple, you have more chances of improving the situation than by dealing with it alone. Your partner may have ideas of their own or be informed about resources that could save your home from foreclosure.

- If your home is foreclosed on, your partner is going to find out anyway. They are likely to be even more upset that you didn’t tell them until it was too late.

Take Action

When it comes to foreclosure, the worst action you can take is no action at all. When you sit on it, the lender forecloses, your property gets sold, and then you receive an eviction notice. If you are afraid to tell your spouse, you can ask a close friend, family member, counselor, or lawyer to be present as support. An unbiased third person to guide the conversation can help keep things calm and collected. You may find that your spouse responds better than you had thought, and mostly because you finally decided to tell them. In fact, your spouse may have had a feeling something was going on, and was hoping you’d bring it to their attention.

Another not-so-great option is to borrow more money from the bank to reinstate your loan without consulting with a lawyer first. Reinstating the loan may be a good option if the monetary setback was only temporary, and you will have income to begin making payments timely and fully. However, if you cannot fulfill the monthly payments required of you, you may eventually face foreclosure anyway.

Fighting a Foreclosure

Fighting foreclosure is a necessary action to take if facing this unfortunate occurrence. There are many different ways that a foreclosure can be fought and each may save your home or property. One of the most common ways that is recommended is to file for bankruptcy. Filing for bankruptcy can help to provide some financial relief for those who are struggling to pay off debts.

The type of bankruptcy that is recommended to file for in this case is Chapter 13. Chapter 13 is generally filed by individuals and puts them on a repayment plan to pay back creditors over a 3 to 5-year period. What makes this favorable for foreclosure is that this bankruptcy type doesn’t require the liquidation of assets like in a Chapter 7 bankruptcy. Chapter 7 is also a typically individual filed bankruptcy type but requires the liquidation of assets that many times may require the selling of a home or property. Your Hartford, CT foreclosure lawyer can fill you in more on the details of fighting foreclosure and filing for bankruptcy.

Important Things to Know

When facing foreclosure, there are some critical things to understand. A foreclosure lawyer in Hartford, CT will tell you that it’s crucial that all paperwork is provided by the foreclosing party. They must also be able to provide proof that they authorized and own the loan. There have been cases where the party who conducted the loan cannot prove that they have the loan in their files. When this happens a foreclosure may be deemed incorrect.

It’s also critical that state law is followed by the foreclosing party. If they skipped an important step or didn’t follow the rules for the foreclosure then this may also prove that the foreclosure is invalid. Ensure that all documents are reviewed and that the mortgage company calculated the correct mortgage payments too. Your legal counsel from The Law Offices of Ronald I. Chorches can provide you the best chance at keeping your property.

Potential Actions to Take

Filing for a chapter 13 bankruptcy may be one of the best options to take in the foreclosure scenario. Make sure to discuss this with your lawyer from The Law Offices of Ronald I. Chorches. We have helped numerous clients fight foreclosure and helped them to keep their homes. If you happen to be on active duty status in the military then special provisions exist to not be foreclosed on for a certain period of time. We will take the time to review your case with you and help you to understand better why and how this foreclosure has come about. It’s important to not panic as many times a foreclosure is found to be made in error. Reach out to us today to learn more about your case and how we can help you keep your home or property.

Scheduling a Consultation with a Foreclosure Lawyer

If your mortgage lender is threatening foreclosure, it’s important to discuss your case with a foreclosure lawyer promptly. During your initial consultation, tell your lawyer details about your foreclosure, such as how behind you are in payments. You’ll also want to ask your lawyer several questions, like whether or not you have a good defense for foreclosure or how long the process may take.

Schedule a meeting with a foreclosure lawyer in Hartford, Conneticut from The Law Offices of Ronald I. Chorches today to discuss your case.

We also service clients from Bridgeport, Waterbury, and New Haven.