Bridgeport CT Bankruptcy Lawyer

Are you concerned about the potential consequences associated with filing for bankruptcy in Connecticut? Connect with an experienced Bridgeport CT bankruptcy lawyer at The Law Offices of Ronald I. Chorches for help.

Thousands of Americans file for bankruptcy each year, due to a variety of reasons. When debt becomes overwhelming and difficult to manage, filing for bankruptcy can be the right solution. Bankruptcy can lift many people out of debt and put them back on a track to financial freedom. Navigating the bankruptcy process alone can be stressful and confusing. Therefore, it is recommended to obtain the support of a top bankruptcy lawyer who can help.

- Personal Bankruptcy FAQ

- How to Improve Credit Score After Bankruptcy

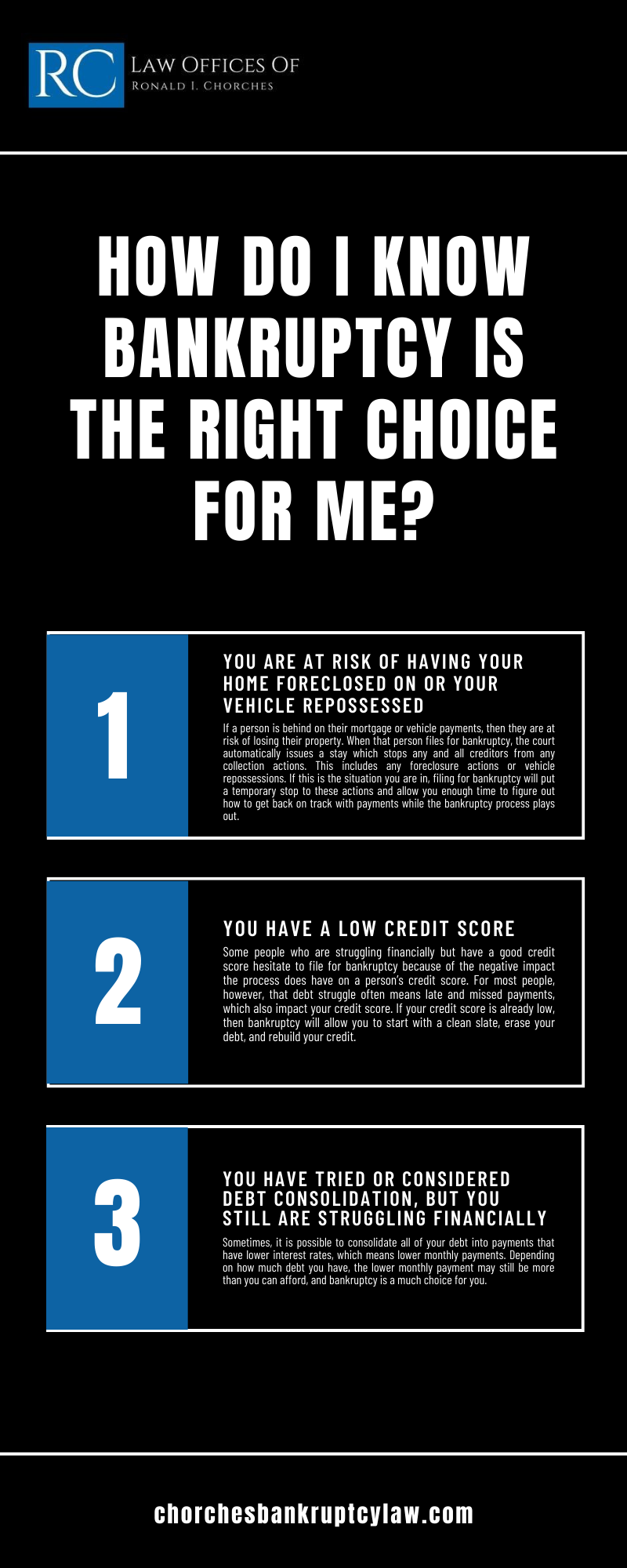

- How Do I Know Bankruptcy is the Right Choice for Me?

- HOW DO I KNOW BANKRUPTCY IS THE RIGHT CHOICE FOR ME INFOGRAPHIC

- Chapter 13 Automatic Stay

Bankruptcy Lawyer – Bridgeport, CT

All too often, Americans who are struggling with debt shy away from the idea of filing for bankruptcy. They are under the impression that, in doing so, they will destroy their ability to build a stable financial future. Conversely, filing for bankruptcy is the best possible opportunity that many Americans have to regain financial stability and security. Working with an expert bankruptcy lawyer can help you take control of your financial situation.

Bankruptcy Can Happen to Anyone

Anyone can fall victim to bankruptcy, regardless of income, credit history, or financial background. It does not matter if you have good spending habits. In many cases, bankruptcy is caused by a sudden job loss or large medical expense. Some people who file for bankruptcy do so because of an expense that they cannot afford to pay. Whether you have accrued large amounts of debt, or must pay off a significant single expense, bankruptcy could be the right option for you to solve your financial problem.

Common Types of Bankruptcy

There are several types of bankruptcy you can file for. First, understand which types of bankruptcy applies to your situation. For more information about the details and eligibility requirements for each type, consult with a bankruptcy lawyer. They will be able to explain each one in depth. Which type of bankruptcy you file for will depend on your income, the type of debt that you have, and whether you want to keep your property

- Chapter 7. For those looking to complete bankruptcy in just a few months, filing for Chapter 7 bankruptcy may be the preferred choice. Many types of debt are eligible to be wiped out under Chapter 7 bankruptcy. Such debts include personal loans, credit card bills and utility bills. Some types of debt like student loans are not eligible. Therefore, it’s important to make sure to check that this type of bankruptcy is suitable for the type of debt that you have.

- Chapter 13. Unlike Chapter 7 bankruptcy, Chapter 7 is not an immediate process. This form of bankruptcy takes several years to complete rather than months. The benefits of filing Chapter 13 is that you can keep your home and other assets that you have. It can temporarily stop the foreclosure process. Individuals who opt for Chapter 13 bankruptcy will have to agree to a payment plan that they can afford, so they have to be careful not to miss a payment.

Personal Bankruptcy FAQ

Unsure of whether filing for Chapter 7 or Chapter 13 is the best option for your circumstances? A Bridgeport CT Bankruptcy Lawyer at our firm can provide you with the personalized insight you’ll need to make an informed choice either way. Understand that when you meet with a dedicated lawyer at our firm, they’ll be able to expand upon these general answers. They’ll tailor how these “rules of thumb” may apply to your unique situation.

How Long Does the Bankruptcy Process Take?

The Chapter 7 bankruptcy process is generally resolved within a matter of a few months. The Chapter 13 bankruptcy process takes 3-5 years. The reason that the Chapter 7 bankruptcy process is shorter is that successful Chapter 7 filers have their eligible debt forgiven without needing to pay any of it back over time. Chapter 13 filers can only have eligible debts forgiven after they’ve spent 3-5 years making manageable debt payments after their overall debt load has been restructured.

Can I File for Bankruptcy Without a Lawyer?

If you are eligible for Chapter 7 bankruptcy relief and your finances are exceptionally straightforward, you may be able to use a reputable non-profit bankruptcy filing service – like Upsolve – to file for free without an attorney. However, this is the exception to the general rule that given the complexities of the process and how high the stakes of a bankruptcy case are, almost everyone (including all Chapter 13 filers) needs to work with an attorney in order to file for bankruptcy successfully.

Will I Lose My Property if I File for Bankruptcy?

If you file for Chapter 7 bankruptcy, a trustee will be assigned to your case. This trustee is technically empowered to sell any of your assets that are classified as non-exempt so that those assets can be sold to benefit your creditors. However, it is critically important to understand that almost no one who is eligible for this kind of bankruptcy relief is at risk of having their assets sold. Most Chapter 7 filers are able to exempt all of their property from this risk.

Do My Spouse and I Need to File for Bankruptcy Separately?

No. States allow married couples to file for bankruptcy jointly, just as they are permitted to file for taxes jointly.

What Kinds of Debt Are Eligible for Discharge?

Generally speaking, most debts that are unsecured are eligible for discharge under Chapter 7 or Chapter 13 of the Bankruptcy Code. Certain tax debts, outstanding spousal support and child support payments, and other exceptions to this rule apply. But, most of the time, if a debt isn’t secured by collateral (like a home loan or an auto loan), that debt is eligible for discharge. If you have questions about how bankruptcy discharge rules will apply to your debts specifically, connect a knowledgeable Bridgeport bankruptcy lawyer at The Law Offices of Ronald I. Chorches today.

Will Filing for Bankruptcy Destroy My Credit?

It is true that filing for bankruptcy will result in a significant drop in your credit score and a negative mark on your credit history that will not “drop off” for 7-10 years. However, it is important to understand that the negative impact of your bankruptcy filing will lessen over time. The older that your bankruptcy filing is, the less that lenders will take it into consideration when determining whether to extend you credit.

Additionally, if you take advantage of the fresh start that bankruptcy provides by building healthy debt management habits over time, your credit score will improve and improve and improve. Marketwatch indicates that within four years of filing for bankruptcy, you may be able to regain a credit score in the 700 range. Many people who don’t file for bankruptcy struggle with massive debt issues for years on end. This struggle can tank one’s credit score.

When you file for bankruptcy, you give yourself the opportunity to build a better credit history than you’ve had in some time. By contrast, if you continue to struggle with debt with no end in sight, your credit score will continue to suffer. It is for this reason that some lenders actually look favorably on a bankruptcy filing, provided that the consumer in question has developed healthy habits post-filing. In this way, bankruptcy serves as proof that you’ve taken control of your finances and are unlikely to struggle with new lines of credit moving forward.

How to Improve Credit Score After Bankruptcy

Bankruptcy does not permanently ruin your life. It can actually be a stepping stone to a more promising financial future. You can seize control of your life and work on your financial management so that you can rebuild your credit score and avoid future debt issues. By keeping habits like making on-time payments, staying on top of your spending, and sticking to mindful purchases, you can slowly but surely improve your credit score shortly after bankruptcy.

Legal Assistance Is Available

It is not too late to recover financially if you are struggling with debt. If you have not yet scheduled a consultation with The Law Offices of Ronald I. Chorches to discuss the “ins and outs” of your unique financial circumstances, please do so now. Once we’ve evaluated your situation, we’ll be able to provide you with objective feedback about your options and the likely pros and cons of each of those options. That way, you can make an informed decision about whichever approach to debt management and debt relief will serve your family best. Connect with our experienced Bridgeport, CT bankruptcy lawyer team today to learn more; we look forward to speaking with you.

How Do I Know Bankruptcy is the Right Choice for Me?

No one wants to file for bankruptcy, but there are many situations where it is the best legal option available. A bankruptcy lawyer in Bridgeport, CT knows that many people think filing for bankruptcy is something to feel embarrassed about, but the truth is that many people who are struggling with debt choose this process so they can obtain a fresh financial start. In fact, approximately one million people file for bankruptcy in this country each year.

If you are truly unable to pay your bills, then bankruptcy may be your best option. While not being able to pay your bills is an obvious situation for bankruptcy, there are other situations where bankruptcy may also be the best choice.

Although every situation is different, if any of the following apply to you, you will want to speak to a Bridgeport, CT bankruptcy lawyer to find out what legal options are available to you:

You are at risk of having your home foreclosed on or your vehicle repossessed.

If a person is behind on their mortgage or vehicle payments, then they are at risk of losing their property. When that person files for bankruptcy, the court automatically issues a stay which stops any and all creditors from any collection actions. This includes any foreclosure actions or vehicle repossessions. If this is the situation you are in, filing for bankruptcy will put a temporary stop to these actions and allow you enough time to figure out how to get back on track with payments while the bankruptcy process plays out.

You have a low credit score.

Some people who are struggling financially but have a good credit score hesitate to file for bankruptcy because of the negative impact the process does have on a person’s credit score. For most people, however, that debt struggle often means late and missed payments, which also impact your credit score. If your credit score is already low, then bankruptcy will allow you to start with a clean slate, erase your debt, and rebuild your credit.

You have tried or considered debt consolidation, but you still are struggling financially.

Sometimes, it is possible to consolidate all of your debt into payments that have lower interest rates, which means lower monthly payments. Depending on how much debt you have, the lower monthly payment may still be more than you can afford, and bankruptcy is a much choice for you.

HOW DO I KNOW BANKRUPTCY IS THE RIGHT CHOICE FOR ME INFOGRAPHIC

Bridgeport Bankruptcy Law Statistics

According to the United States Courts, there were 413,616 bankruptcy petitions filed in 2021. Approximately 288,000 people filed for Chapter 7 bankruptcy and 120,000 filed for Chapter 13 bankruptcy. In Connecticut, there were just under 3,000 bankruptcy petitions filed in 2021 – 2,545 were Chapter 7 and 398 petitions were Chapter 13.

Let Us Help

If you are thinking that bankruptcy may be the right choice for you, call The Law Offices of Ronald I. Chorches. We’ll schedule a free and confidential consultation with a Bridgeport, CT bankruptcy lawyer. We will evaluate your situation and discuss what bankruptcy options you may have. Furthermore, we’ll advise you on which option would be the most beneficial for your circumstances.

Chapter 13 Automatic Stay

When a person files a Chapter 13 bankruptcy protection, there is generally an automatic stay granted by the court. In simple terms, an automatic stay provides the petitioner with temporary relief from debt collection efforts. This includes relief from creditors that are seeking enforcement of a judgment, foreclose on a property, or the collection of debt in any other manner.

Creditors are legally obligated to put all of those collection efforts on temporary hold. This is extremely useful for the petitioner as it gives them some space to devise a workable restructuring plan. However, creditors do not always abide by the automatic stay. If you have been granted an automatic stay, and a creditor is continuing to take collection action, your legal rights are being violated.

Notifying the Creditor

In some cases, the violation of the automatic stay is occurring as the result of an error. For example, the creditor may not even be aware of the automatic stay. Of course, they should have been informed and it is possible that their lack of knowledge is due to their own negligence. Still, if a creditor is taking collection action in violation of an automatic stay, you should first inform them of the existence of the stay. At that point, the creditor would have legal duty to put an immediate stop to illicit debt collection efforts. This action alone may solve the problem. However, if the creditor continues to take collection action, you will need to escalate the issue.

Notifying the Court

If you notify the creditor, and nothing changes, you should bring the issue to the attention of the bankruptcy court. It is best to do this through your Bridgeport bankruptcy lawyer. The bankruptcy court has the power to take corrective legal action against the overly-aggressive creditor. In some cases, the court may sanction or fine the violating creditor. You must take swift action to notify the court because if you fail to do so, it could cause significant problems in your bankruptcy case.

Filing a Lawsuit

If the creditor fails to cease collection activity, it may become necessary to file a separate lawsuit outside of the bankruptcy court. This is rare, but in some cases, it will be advisable. All creditors in Connecticut are governed by the state’s fair debt collection regulations. Creditors that violate these rules must be held fully accountable. By filing a lawsuit, you may be able to not only get injunctive relief to put a stop to the collection efforts but you may also be entitled to recover compensation as a result of the bad actions of the violating creditor.

Avoiding Bankruptcy Issues

Although some people may try to file for Chapter 13 pro se (without a lawyer), the process itself can be complex and if any errors are made, it could result in the bankruptcy petition being dismissed and the need to refile. This can have disastrous consequences if you are facing foreclosure of your home or other imminent collection action that an automatic stay could halt. Call The Law Offices of Ronald I. Chorches to schedule a free consultation with a skilled Bridgeport bankruptcy lawyer and find out how we can help.

We also service clients from Middletown, New Haven, and West Hartford.