Foreclosure Defense Lawyer Connecticut

How Our Lawyers Can Help

We have a team of experienced foreclosure defense lawyers in Connecticut that can provide many different services. When you work with our team, we can help you discuss options and determine what method is best for preventing foreclosure.

Bankruptcy

Although people sometimes get scared when they hear the term, “bankruptcy”, bankruptcy come be a powerful tool at your disposal when handled properly. An immediate benefit is the automatic stay which prevents lenders and their agents from trying to collect money during the bankruptcy period. Bankruptcy can help save your home. At our law firm, we deal with both Chapter 7 and Chapter 13 bankruptcies.

Chapter 7 Bankruptcy

Bankruptcy can eliminate any debts attached to your home. This includes mortgage which can take a serious toll on homeowners. Chapter 7 bankruptcy also grants the possibility of having certain tax liabilities forgiven. These are losses that a lender takes on due to a homeowner’s default.

Under a Chapter 7 Bankruptcy, there’s a chance that you might not be able to keep your home. Additionally, you may have to give up some of your possessions or assets to pay back part of the debt. However, when done properly, this form of bankruptcy may allow you to keep up to $75,000 in equity.

Chapter 13 Bankruptcy

Chapter 13 Bankruptcy will allow you to set up a payment plan which you can use as a method to pay off your debt. You’ll need enough money to pay off your debt and regular mortgage payments. However, Chapter 13 Bankruptcy can help you prevent second or even third mortgage payments.

One drawback of this type of bankruptcy, however, is that the lender may file a motion to remove the automatic stay. If successful then the court can move forward in conducting the sale of your home. In this scenario, you may not have enough time to get all your matters into order.

The best way to prevent a negative outcome when you’re facing foreclosure is to get in touch with our office immediately. By working with one of our lawyers you can postpone your foreclosure or prevent it entirely. Our team will give you the right legal defense and help you determine the best course of action.

Different Things to Consider

Foreclosures don’t have to be faced alone. They are often complex and technical things with a lot of different details involved. That’s why turning to a foreclosure defense lawyer in Connecticut is so important. A lawyer specializing in this type of law from The Law Offices of Ronald I. Chorches can be the difference between keeping your home/property or losing it. There are many occurrences where an error has been made by a bank or entity providing a loan. These errors can change the outcome of a foreclosure. Furthermore, these errors are generally found through different documentation or even from a lack of proper documents. For this reason, ensure that proper documentation is provided from all properties involved with foreclosure. It could be the difference between property loss and keeping your home.

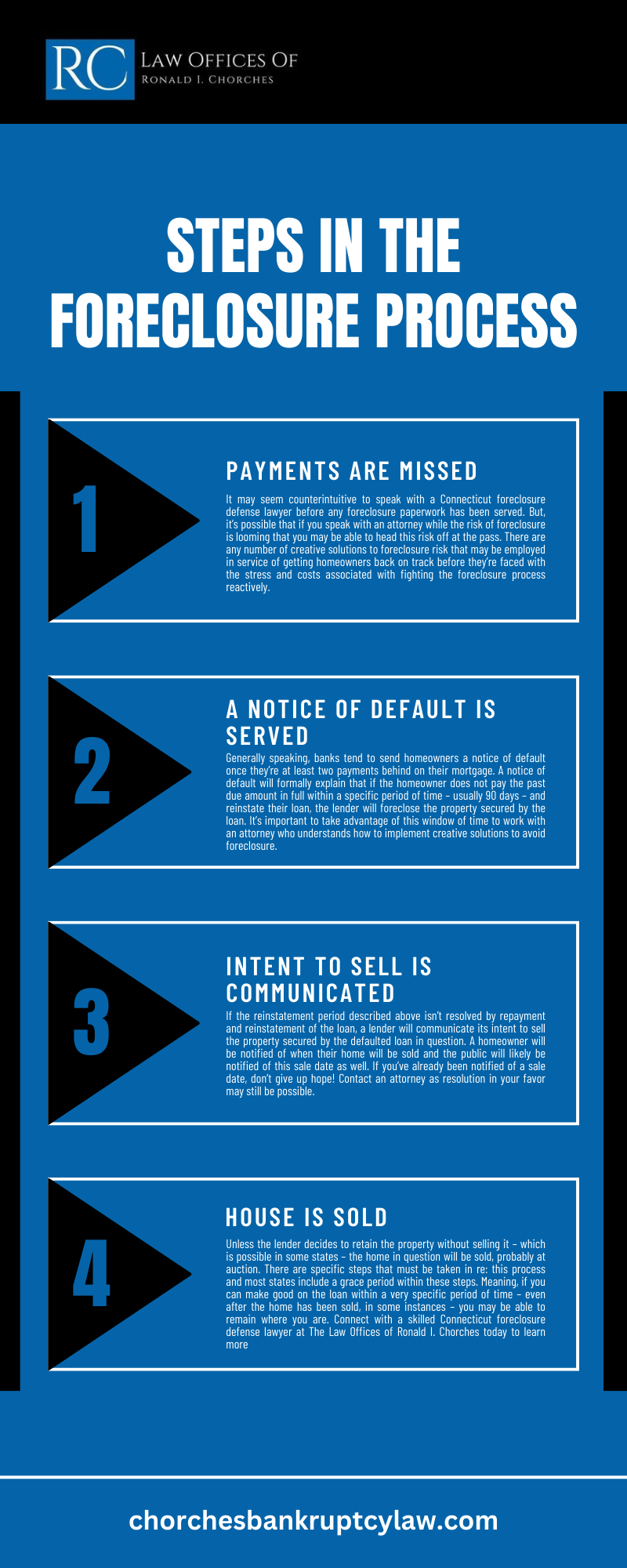

STEPS IN THE FORECLOSURE PROCESS

Connect with a skilled foreclosure defense lawyer Connecticut homeowners trust without delay if your home is at-risk of foreclosure or the foreclosure process has already been initiated by your lender. It’s important to be proactive when it comes to seeking legal counsel. The more quickly you connect with The Law Offices of Ronald I. Chorches, the more opportunities we’ll have to halt foreclosure during the various stages of the process.

Review the basic steps of the foreclosure process below for a greater understanding of the circumstances you’re facing. Moreover, learn why it’s so important to benefit from experienced legal guidance when facing such challenges.

Step One: Payments Are Missed

It may seem counterintuitive to speak with a Connecticut foreclosure defense lawyer before any foreclosure paperwork has been served. But, it’s possible that if you speak with an attorney while the risk of foreclosure is looming that you may be able to head this risk off at the pass. There are any number of creative solutions to foreclosure risk that may be employed in service of getting homeowners back on track before they’re faced with the stress and costs associated with fighting the foreclosure process reactively.

If you’ve missed one or more mortgage payments and you’re struggling to figure out how to avoid foreclosure, speak with our legal team today. We may be able to help in truly consequential ways.

Step Two: A Notice of Default Is Served

Generally speaking, banks tend to send homeowners a notice of default once they’re at least two payments behind on their mortgage. A notice of default formally explains that if the homeowner does not pay the past due amount in full, the lender will foreclose the property. It’s important to take advantage of this window of time to work with an attorney who understands how to implement creative solutions to avoid foreclosure.

Step Three: Intent to Sell Is Communicated

If the reinstatement period described above isn’t resolved by repayment and reinstatement of the loan, a lender will communicate its intent to sell the property secured by the defaulted loan in question. A homeowner will be notified of when their home will be sold and the public will likely be notified of this sale date as well. If you’ve already been notified of a sale date, don’t give up hope! Contact an attorney as resolution in your favor may still be possible.

Step Four: House Is Sold

Unless the lender decides to retain the property without selling it – which is possible in some states – the home in question will be sold. Most states include a grace period within these steps. Meaning, if you can make good on the loan within a very specific period of time, you may be able to remain where you are. Connect with a skilled Connecticut foreclosure defense lawyer at The Law Offices of Ronald I. Chorches today to learn more.

STEPS IN THE FORECLOSURE PROCESS INFOGRAPHIC

Fighting a Foreclosure

Along with errors made by different parties, there are also some other key ways to fight a foreclosure. If the loan company or bank hasn’t followed proper state law in the foreclosing process then it may be able to be declined. Your foreclosure defense lawyer in Connecticut can fill you in more on the details of this type of occurrence. Something else to know that is crucial is if the person being foreclosed on is a part of the military and on active duty status. There exist some special benefits for active military members that prohibit foreclosure during a certain period of time. Your legal counsel team from The Law Offices of Ronald I. Chorches can assist you with the statute of limitations and other timelines and details regarding this process.

Other Ways of Challenging a Foreclosure

Finally, filing for chapter 13 bankruptcy may also be in the best interest of the person fighting foreclosure. When someone is going through difficult financial times and also facing a possible foreclosure, filing for bankruptcy may be able to help. This is because filing for a chapter 13 bankruptcy puts that person on a repayment plan to pay off their debts. They are not required to liquidate assets and oftentimes are able to keep the home as long as they come to an agreement with continuing to make payments on the home.

Experienced Legal Counsel

Foreclosure defense lawyers from our firm have years of experience in helping clients who are facing foreclosure. We believe that we can help you or someone you know with the foreclosure process. It’s our goal to help you keep your home or property. Our knowledge, skills, and experience have helped many people navigate their way through foreclosure and have helped them find ways to keep their homes. Going through a foreclosure if you haven’t been through one before can be a difficult and complex process. The different details involved with the process as well as the statute of limitations can be tricky to understand. Contact us today to learn more about how we can help you keep your home and property.

Contact Our Office Today

Dealing with a foreclosure can be extremely stressful. In addition to worrying about losing your home, a foreclosure can negatively impact your credit score. By working with one of our experienced foreclosure defense lawyers in Connecticut, you can help prevent the foreclosure process from occurring.

Who pays foreclosure costs?

Assuming that a homeowner can pay off the loan, they will be responsible for covering the costs of foreclosure. But if the property is sold to someone else, then that new owner of the property has to pay the costs. There are times when the lender will buy the property at the auction event. However, they will have to cover the foreclosure costs, which they may try to get repayment for by reselling the property.

I got notification that I missed payment, what now?

If you received notice of your missed payments, you must contact the loss mitigation department for your lender. At best, do this as quickly as you can once you know that you won’t be able to make a payment. The quicker you act, the more choices that can be provided to work out an alternative to foreclosure. It’s best to have your financial details ready when you contact the loss mitigation department. Therefore, they can promptly determine what options are available to you.

Which documents are part of a foreclosure?

The key documents involved in a foreclosure are the mortgage or deed of trust and promissory note. The lender may also need to show evidence of missed payments. Other information needed will include evidence of how much is left on the loan, address for the property, added charges, and modifications made to the original loan agreement. A Connecticut foreclosure defense lawyer can inform you about other documents that may be helpful when handling or halting the foreclosure.

What alternatives are available for foreclosure?

There are several alternatives to foreclosure. Some are temporary, and others are permanent. Some permit you to remain in your home, and others offer a less disruptive way to move out than foreclosure. Based on your situation, you may be allowed to modify your loan to lower your monthly payments while prolonging the loan term. You may be able to obtain a repayment plan or short-term forbearance agreement to address a temporary hardship. If you have already chosen to move out, you can arrange for a deed in lieu of foreclosure. Moreover, a short sale can be used to avoid the negative impact that foreclosure will have on your credit.

How likely is it that I can reduce my loan and stay?

Lenders often offer modifications to a loan, or they may accept a late or partial payment for the shorter term, as long as you agree to eventually catch up on the discrepancy. Some loan companies offer further options to modify the loan, and may entail reducing your interest rate for a set period. Your lawyer can go over with you your loan modification application and answer any questions you may have. If you continue to not keep up with reduced payments, the lender may begin the foreclosure process again, and may not be as willing to offer a second modification.

If you need assistance regarding a foreclosure issue, contact a Connecticut foreclosure defense lawyer from The Law Offices of Ronald I. Chorches.

Frequently Asked Questions Regarding Chapter 13 and Foreclosure

When facing financial challenges and the possibility of losing your home, consult a Connecticut foreclosure defense lawyer. Those facing home foreclosure and overwhelming financial obligations may need to research the options they have available to them. The prospect of foreclosure can be incredibly stressful and even cause people to experience significant levels of shame. However, choosing Chapter 13 can be a way for those having trouble paying their debts to remain in their homes and also retain some of their assets.

What is Chapter 13 bankruptcy?

Chapter 13 bankruptcy is one of the more popular forms of a bankruptcy filing. Chapter 13 is known as the wage earner’s plan, which is usually the most appropriate option for those who do not qualify for Chapter 7. Through Chapter 13, those eligible will develop a repayment plan that allows them to have some debts forgiven and others repaid over the course of three to five years. For those who would like to remain in their homes, Chapter 13 bankruptcy is typically the best possible option.

Who are the appropriate candidates for Chapter 13 bankruptcy?

Chapter 13 can be a viable option for many; however, it’s not suitable for everyone. It’s not the best option for those with an income below the state’s median average. Chapter 7 is usually the more appropriate option for people with lower incomes. Since a person filing for Chapter 13 repays much of their debts through restructuring, much of their obligations are not forgiven. They will instead pay these debts off over time. Because of this, those filing for Chapter 13 must draw enough income to cover the payment obligations they will require through the payment process.

How can Chapter 13 prevent foreclosure on a person’s property?

The foreclosure process may sometimes initiate before a person files for Chapter 13. When a person cannot pay their mortgage, home lenders make efforts to regain some of what they have lost. One way that a mortgage lender will seek to recover what they have lost is to foreclose on the home of the borrower. However, when a person files for bankruptcy, they are granted an automatic stay. This means that attempts to recover debts must halt until the bankruptcy resolves.

What debts can be discharged through Chapter 13 bankruptcy?

There are a few things to be aware of when considering which debts may be discharged or forgiven through bankruptcy. In Chapter 13, remember that many debtors may be looking to retain some of their assets through a repayment plan. The typical secured debts like homes and cars may be forgiven if the debtor is willing to give them up. Otherwise, they will be paid off through the restructuring. However, note that unsecured debts, like tax payments, child support, etc., can never be forgiven. Most debts discharged in Chapter 13 are Nonpriority unsecured debts. These make up things like credit card debts, medical bills, utility payments, etc., which may not have to be repaid.

Why should those facing foreclosure speak with a lawyer before moving forward?

There are several phases to the foreclosure process. While the foreclosure process does not resolve overnight, it’s still important to consult with a lawyer before it’s too late. Typically there are several opportunities to resolve issues when a loan is in default. Once payments have been missed, the first step is to speak with lenders to develop a plan to catch up on mortgage payments. This may not be possible for some, as it will be necessary to determine other plausible options. Chapter 13 may be an appropriate solution as it will allow borrowers to remain in their homes.

The possibility of losing a family home can be challenging to come to terms with. For some, there may be plausible options for preventing the foreclosure process. A Connecticut foreclosure defense lawyer from The Law Offices of Ronald l. Chorches will help. Schedule a consultation as quickly as possible.

Our service area includes Bridgeport, Waterbury, and New Haven.