Financially Struggling Households Are Increasingly Turning To Credit Cards

Credit card debt levels are skyrocketing to levels not seen since prior to the 2008 Financial Crisis. As CNN reports, the average household is now carrying $15,654 in credit card debt. What is even more alarming is that most Americans are using their credit cards not necessarily for frivolous expenses like eating out or clothes shopping, but simply to make ends meet.

Furthermore, with the average household currently paying more than $1,000 per year in interest alone on their credit cards, the financial strain will likely get worse in 2018 as the Federal Reserve has indicated it will continue raising interest rates.

Necessities Drive Credit Card Debt

As CNBC reports, a recent survey of 1,000 consumers found that the most common reason people went into credit card debt was in order “to make ends meet,” which was cited as a reason by 42 percent of respondents. Car repairs came second, at 29 percent, and medical bills third, at 27 percent.

Also See:

Those responses suggest a couple of troubling conclusions: one, that basic necessities are driving people to get deeper into credit card debt and, two, that many Americans don’t have enough savings to cover unexpected expenses, like medical expenses, when they arise, forcing them to put them on their credit cards.

The problem is likely due to the rising cost of living. Medical expenses alone have shot up by 32 percent in the last decade, while food and beverage costs have gone up by 22 percent. As a result, many Americans can neither afford to save up money to cover unexpected expenses and must rely on their credit cards just so that they can meet their basic necessities.

Things Look Likely To Get Worse

Credit card debt represents only six percent of household income, but because credit cards come with such high interest rates they can quickly turn into an unmanageable problem. Currently, the average household spends nearly $1,333 per year on credit card interest alone, assuming an average interest rate of 19.36 percent.

Given that the Federal Reserve has already begun raising interest rates and is expected to continue to do so into 2018, the amount people are spending on credit card debt is likely to keep going up. For those who already rely on their credit cards to make ends meet, rising interest rates could prove too much to handle.

As a bankruptcy firm, we also expect to see an increase in people declaring bankruptcy to stop their credit card debts in order to put an end to their debts constantly increasing or so stop legal action taken against them.

Getting Out of Debt

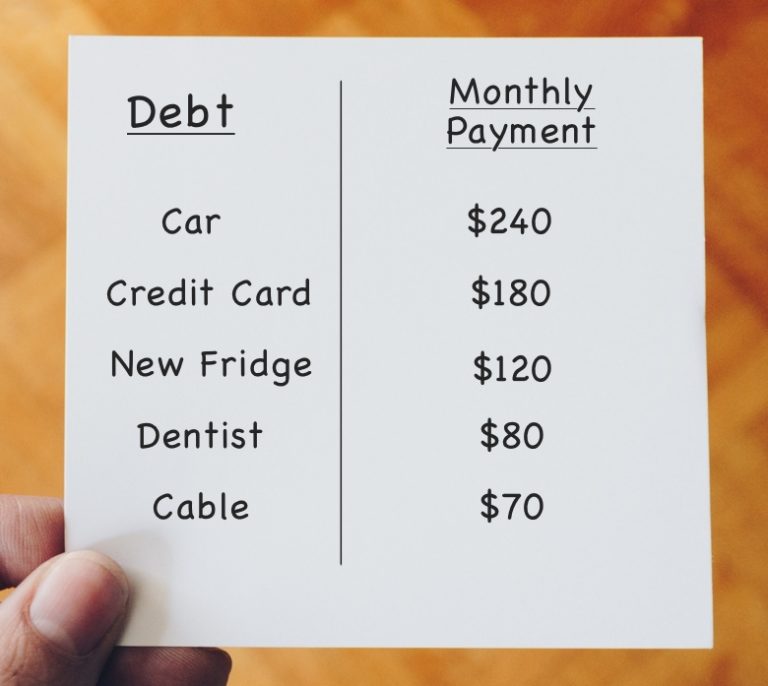

Debt can quickly feel overwhelming, especially when you’re struggling to keep up with minimum payments and dealing with harassing phone calls from creditors. One way to address the problem may be to consider bankruptcy.

If creditors are harassing you, read out advice on stopping harassing creditors for ways to make the phone calls and letters stop.

A bankruptcy attorney can show you how bankruptcy may be able to stop the endless bill payments and harassing phone calls and give them the breathing space they need to rebuild their finances.