Will Declaring Bankruptcy Stop Me from Getting A Job In Hartford?

A Chapter 7 or Chapter 13 bankruptcy should not affect your ability to get a job or to keep a job if you have one.

The main concern will be for jobs where you are expected to be good at handling money as part of your job requirements.

However, bankruptcy may affect your ability to get or keep a job which requires certain types of security clearances.

But in most cases, your employer won’t even know that you filed for bankruptcy unless you tell them.

In other cases, the employer may learn that you have but probably won’t have a problem with the filing.

Keeping your job if you already have one

The right to file for bankruptcy protection is actually set forth in the US Constitution.

Additionally, public and private employers can’t alter the terms of your employment if they discover your bankruptcy.

This means that the employer:

- Should not reduce your wages or salary because you declared bankruptcy

- Should not assign you to a lower paying job, or a job that requires less skills or talents

You can lose your job or be demoted because of general work performance issues such as dishonesty, being late to work, not performing your job duties, and not achieving the results the employer expects.

But when it comes to bankruptcy, you’re completely protected.

How an employer might find out about your bankruptcy filing

There are two main types of consumer/debtor bankruptcies.

You use a Chapter 7 bankruptcy if you don’t have secured debts such as a home or such as priority debts that you need time to pay off – but that you can’t discharge.

In a Chapter 7, you typically file the bankruptcy petition, attend a creditors’ meeting, and then about six months later – your unsecured debts are discharged.

Normally, the court or trustee doesn’t notify the employer.

Generally, an employer will find out about the fact that you filed for bankruptcy protection if they were already paying a creditor through an existing wage garnishment.

A wage garnishment generally arises when a creditor obtains a judgment against you.

Some states allow the creditor to garnish you wages – to take a preset amount or a percentage of your pay, before you are paid your income.

If you file for bankruptcy protection in a Chapter 7, then the court or trustee or your lawyer will normally inform your employer that your debts have been discharged (on successful completion of the bankruptcy process) and that there is no more need to garnish your wages.

Since the employer knows your debts have been discharged and they don’t have to do the paperwork to garnish your wages, most employers are actually glad that your financial burden is behind you.

If you file a Chapter 13, then you have to propose a plan to pay your secured creditors and non-dischargeable debts.

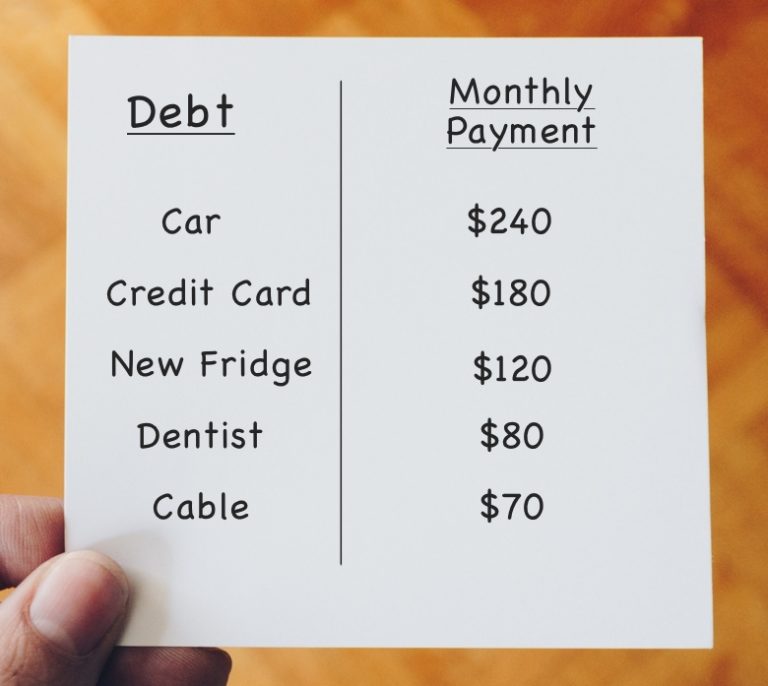

You’ll also need to pay a percentage of your unsecured debts such as your credit cards.

The plan requires you to make monthly payments to the trustee in bankruptcy.

Many bankruptcy courts only require that they get the money on a timely and regular basis.

They don’t care if you pay the monthly amount from your income or if the employer pays it through garnishment.

If you ask your employer to pay the trustee, then the employer will learn of your bankruptcy.

In some courts, especially if you’re late on your payments, the trustee may ask the court for approval to deduct the payment from your paycheck.

If you owe your employer money, then you do need to list that debt on your bankruptcy petition, and then of course your employer will then learn that you have listed them as a creditor.

How bankruptcy affects job applications

No public employer (federal, state, or local) can consider the fact that you filed for bankruptcy when evaluating you for a job.

The same isn’t true for applicants filing for a private job.

While many employers only want to know your experience and your credentials, some employers may have a reason to ask to run a credit check on you.

Bankruptcy petitions stay on your credit record for 10 years, so an employer who runs a credit check may learn that you have filed for bankruptcy.

Employers do need your consent to run a credit check but they can refuse to hire you if you don’t give them permission.

Just because an employer learns that you’ve filed for bankruptcy doesn’t mean you’re automatically disqualified.

Most employers still want to know if you can do the job.

Many employers understand that people get into debt problems.

They also know that having a job is the only way most people can pay their bills.

The potential employer may ask about the circumstances that led to your bankruptcy so that they can feel confident in hiring you.

If you had medical bills, they’ll want to know if your medical problems were taken care – so you can work.

If you had problems due to drinking, they may need some assurances that you are now sober.

A few exceptions

If you are being hired to work with money such as an accountant, then the employer will likely want some assurances that your debt problems were due to other causes (such as medical surgery that wasn’t covered) and not your inability to handle finances.

Some jobs may require a security clearance such as work with the military, with some federal agencies, or with some contractors who do business with federal agencies.

The decision about your security clearance will consider several factors.

There is some concern that people with debt problems could be subject to blackmail.

On the other hand, filing for bankruptcy does show that you are ready to handle your debts and the bankruptcy petition may, very well, work in your favor regarding a security clearance.