Does Filing Bankruptcy Under Connecticut Law Stop An Eviction?

The short answer is yes: tenants that rent an apartment or residence may be able to use a bankruptcy to postpone or even stop an eviction.

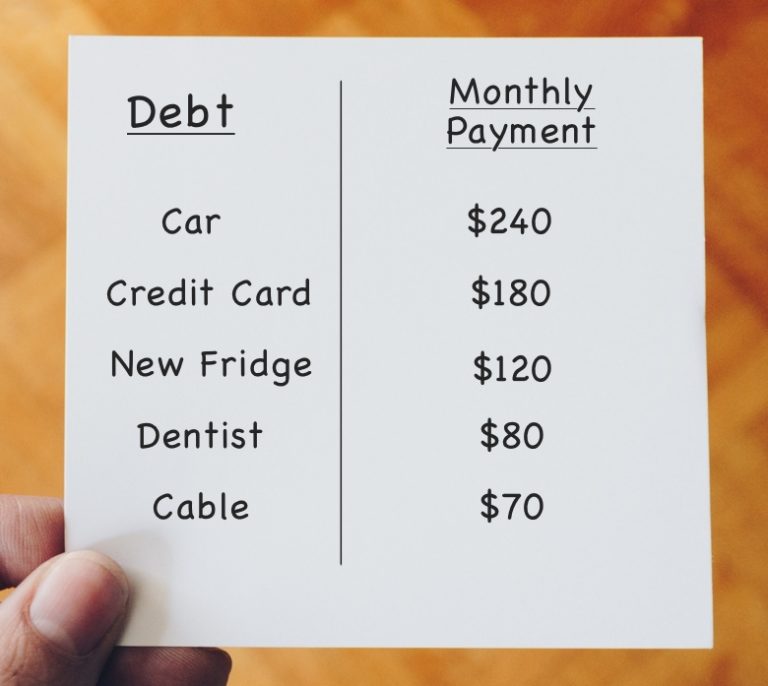

Bankruptcy is generally used to help people that can’t pay their secured debts such as home mortgages and car payments.

Bankruptcy is also useful in helping discharge unsecured debts such as credit card debts and medical bills.

Generally, people in debt use a Chapter 7 to discharge their unsecured debts and use a Chapter 13 to discharge secured debts.

A debt is considered secured if you agree – when you accept the loan to buy a home or car – that the person or company that gave you the loan can sell your home or car if you default on the loan repayments.

Read more details about the differences between secure and unsecured debts here.

Chapter 13 requires that the debtor file a plan in bankruptcy to pay the amount they are behind over a three to five-year period.

All future loan payments must be paid on time.

Staying In Your Home

To stay in your home you still must keep up on your payments.

In home mortgage situations, you can file a Chapter 13 bankruptcy to avoid foreclosure action.

A rental eviction situation is similar but not the same as defaulting on home mortgage payments.

In both cases, the you may no longer be able to keep living in the place where you live and sleep.

And in both those cases, a creditor will eventually try to force you out of their home.

If a you’re in debt, and you own your home, the creditor will try to use a foreclosure action, but foreclosure can be stopped.

If you rent your home, the creditor will attempt to use an eviction action.

The Key Differences

The key difference is that the tenant does not have any ownership interest in their apartment or property.

A second key difference is that the tenant’s rights are determined by the landlord-tenant lease.

In most cases, leases are year-to-year agreements and landlords can refuse to extend a lease beyond the yearly period for almost any reason.

The tenant may consider leaving voluntarily and staying with friends or family until he/she can afford a new apartment to live in.

The Automatic Stay May Stop Tenant Eviction

If you need to continue living in your apartment, declaring bankruptcy and using the automatic stay can offer some help.

If a creditor wishes to proceed against you, he/she must convince the bankruptcy court that the collection and eviction actions should be allowed to continue outside of the bankruptcy court.

When landlords seek to evict a person for nonpayment of the rent, the landlord has two concerns.

- The first concern is that they want to remove the tenant from the building premises – from their apartment

- The second concern is that the landlord wants to be paid for the rent that is due

When a tenant files a bankruptcy, initially there is little the landlord can do to force the tenant to pay the arrearages on the rent, however in some cases landlord does have options:

Filing bankruptcy creates an “automatic stay,” which means that creditors cannot take any action against the debtor without court permission. However, the landlord can still pursue and collect back rent from any guarantors named under the lease, even while the tenant is in bankruptcy. [source]

If the tenant files a Chapter 7, then he/she can normally discharge – with court approval – the past due rental payments.

If the tenant files a Chapter 13, then he/she does pay off the rental arrears over a three to five-year time period.

Generally, if the tenant doesn’t own the property, he or she will not normally use a Chapter 13 unless they are trying to keep their vehicle from being repossessed at the same time. Other rare situations may also justify filing a Chapter 13 bankruptcy.

How Bankruptcy Helps The Landlord

Usually, a landlord who sought to evict a tenant will be able to seek their own relief from the bankruptcy court.

Relief means that the landlord may be able to proceed with the eviction proceedings depending on the circumstances.

Relief isn’t immediate though. The landlord will still need to file papers with the court and wait the allotted time before any action can be taken.

In such cases, the court will likely set up a hearing date so the tenant has a chance to contest the landlord’s request to continue with the eviction.

The bankruptcy court will normally consider a variety of issues in deciding whether to allow the landlord to proceed with the eviction.

These factors include:

- What is the reason the landlord is seeking to evict the tenant?

- Is it an overall financial issue or just a rent problem?

- Is the tenant destroying the property?

- Is the tenant violating the lease by keeping a pet when no pets are allowed?

- How far along are the eviction proceedings?

- Has the tenant made payments in the interim?

If the only reason for the eviction is nonpayment of rent and the tenant catches up on the rent due, that can affect the right to evict regardless of whether there is a bankruptcy case.

As a practical matter, a discharge in bankruptcy doesn’t take that long – usually four to six months.

If the eviction proceeding does take too long, it may make practical sense for the landlord to wait until the discharge is complete.

These are sometimes complicated situations which is why consulting with a bankruptcy attorney is your best recourse.

Commercial Tenants

What if the tenant is a commercial tenant?

A commercial tenant may have an option to buy the place they are renting.

In this case, the tenant may be more inclined to file a Chapter 13 bankruptcy.

Filing For Bankruptcy is a Difficult Choice

People declare bankruptcy for many reasons including loss of income, medical difficulties, divorce, and other reasons.

Sometimes solutions can be worked out short of filing for bankruptcy or going to court for dispute resolution.

When creditors such as landlords won’t negotiate, then filing for bankruptcy may be the only option.

In such cases it’s a great idea to call your local bankruptcy attorney and consult with them regarding your options.

Each situation is different and getting professional representation is the best course of action you can take and will offer you a better chance of protecting yourself from being evicted.