Bankruptcy vs. Debt Consolidation: Which Is Your Best Option?

Knowing the key differences between bankruptcy vs. debt consolidation is crucial for those facing financial challenges. The legal process, impact on credit, and financial obligations vary significantly between the two. Understanding the differences helps individuals make informed decisions based on their financial situations and goals, determining which option aligns better with their needs and situation.

Legal Process

Before filing for bankruptcy, individuals must typically undergo credit counseling. Next, a detailed petition with the bankruptcy court must be filed, followed by court proceedings. On the other hand, debt consolidation primarily involves financial agreements and commitments rather than stringent legal procedures. It focuses on restructuring existing debts to simplify repayment.

Impact on Credit

Bankruptcy has a significant impact on credit scores. It usually stays on credit reports for around seven to ten years for Chapter 7 and three to seven years for Chapter 13. Debt consolidation could briefly lower credit scores because of the new loan inquiry or signing up for the consolidation program. Yet, debt consolidation can gradually improve credit standing over time when handled responsibly with consistent repayment.

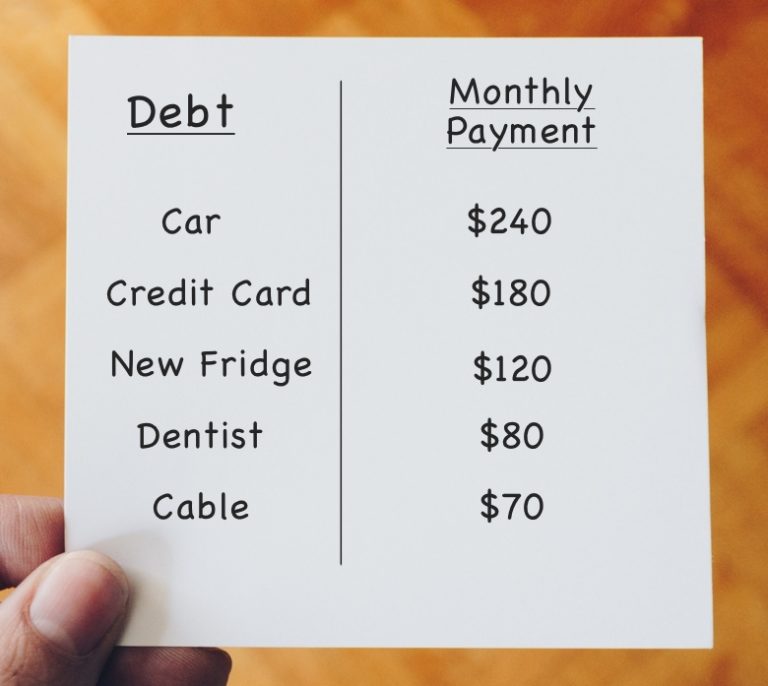

Financial Obligations

During bankruptcy, particularly under Chapter 7, some assets are liquidated. This process involves a court-appointed trustee’s sale of non-exempt assets to generate funds to repay creditors. The goal is to distribute the proceeds among creditors. Conversely, debt consolidation doesn’t entail asset sales. Instead, it focuses on streamlining debt management by restructuring payments or acquiring a new loan to settle existing debts.

In summary, bankruptcy is usually the best option when debt becomes too overwhelming and cannot be paid even when the debt is restructured. On the other hand, debt consolidation is typically the best option for individuals with manageable debt who require a more structured repayment plan.

The Law Offices of Ronald I. Chorches understands the complexities of financial struggles and the weight of debt-related decisions. Whether you’re contemplating bankruptcy or debt consolidation, our experts offer comprehensive consultations to navigate your options. We believe in empowering our clients with the knowledge and understanding necessary to make informed choices. Contact us today for a personalized consultation tailored to your specific circumstances.