6 Ways Filing for Chapter 7 Bankruptcy Could Affect Your Daily Life

Filing for bankruptcy is never an easy decision. There are many things to consider when deciding if it is right for you. There are two…

Filing for bankruptcy is never an easy decision. There are many things to consider when deciding if it is right for you. There are two…

One of the basic and most important protections available when you file a bankruptcy of any type, anywhere, is the Automatic Stay. Essentially, the moment…

Bankruptcy Lawyer If you are considering filing a personal injury lawsuit after someone else caused a recent injury, a very natural question is “How much…

In the majority of situations, filing for a chapter 7 or chapter 13 bankruptcy should not adversely affect your immigration status. For starters, you don’t…

A Chapter 7 or Chapter 13 bankruptcy should not affect your ability to get a job or to keep a job if you have one….

The short answer is yes: tenants that rent an apartment or residence may be able to use a bankruptcy to postpone or even stop an…

In these tough financial times it’s common to worry about whether bankruptcy would mean losing your 401k. For the most part, 401K plans and other…

Even if you have health insurance, medical expenses can still overwhelm you. Without insurance, just one medical emergency or the need for treatment can mean…

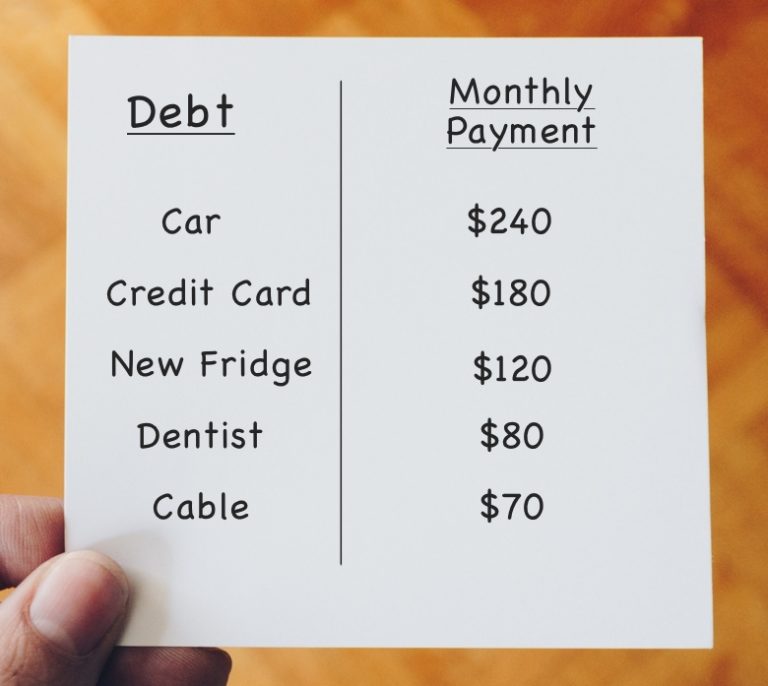

This article explains the top 7 strategies you can use to reduce the stress of your debts and getting your debts under control. As a…

The loss of a job can bring a variety of challenges and stresses. Of course, after losing a job your primary concern is getting back…