Student Loan Debt and Bankruptcy

Federal student loans are loans the U.S. Department of Education provides to help students pay for higher education. The loans are available to eligible students…

Federal student loans are loans the U.S. Department of Education provides to help students pay for higher education. The loans are available to eligible students…

Foreclosure is the legal process that ensues when a borrower fails to make timely payments on a home loan, and the lender takes possession of…

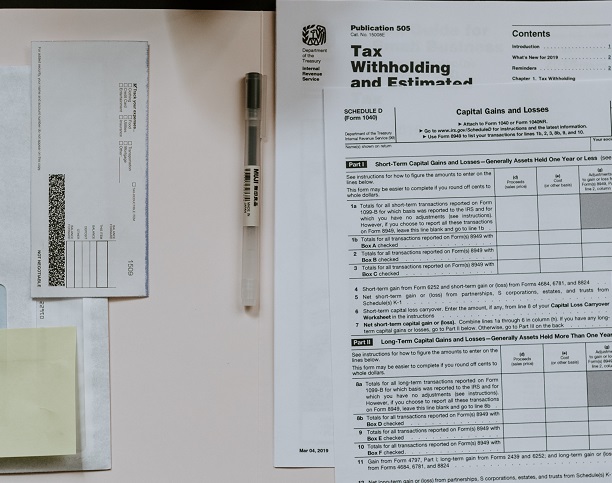

With tax season comes an upswing of bankruptcies. This upward trend may be because federal or state taxes owed, on top of other extensive debt,…

Asset Protection As an asset protection lawyer at our firm can tell you, it’s important to protect everything you’ve worked so hard for — that…

Common Bankruptcy Questions Answered What is bankruptcy? Bankruptcy is a legal process where a debtor, which can be an individual or business, that is unable…

Hartford’s Stilts Building Faces Foreclosure The downtown area in Hartford, CT has long been a prime location for many businesses. However, market fluctuations that have…

Chapter 7 Bankruptcy Lawyer Many people who have gone through or graduated any sort of education beyond government mandated schooling has more than likely had…

Bankruptcy Lawyer Financial struggles affect almost everyone, but if you are having trouble keeping track of your spending and savings, there are some helpful tips…

Chapter 7 bankruptcy is one of the most common types of bankruptcy filings used. It has the potential to help many people get themselves out…

Hiring a lawyer can be a stressful process. To begin with, how can you be sure you even need a lawyer? There are a lot…