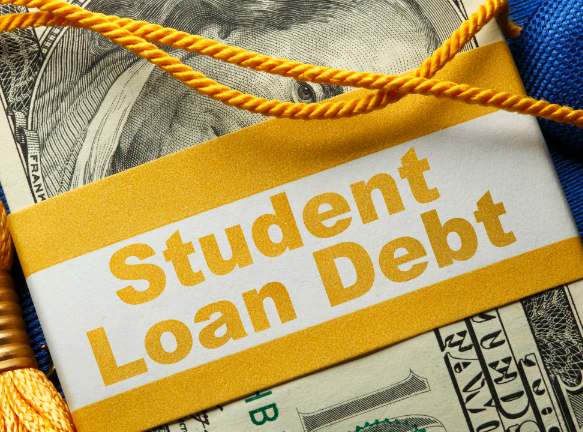

Student Loan Debt and Bankruptcy

Federal student loans are loans the U.S. Department of Education provides to help students pay for higher education. The loans are available to eligible students enrolled in an accredited university or college. According to data from The National Center for Education Statistics, of individuals who obtained a bachelor’s degree in 2016, the average remaining balance of their federal student loans was 92 percent one year after graduation. Indeed, it is common for many to take a decade or longer to pay off their student loans.

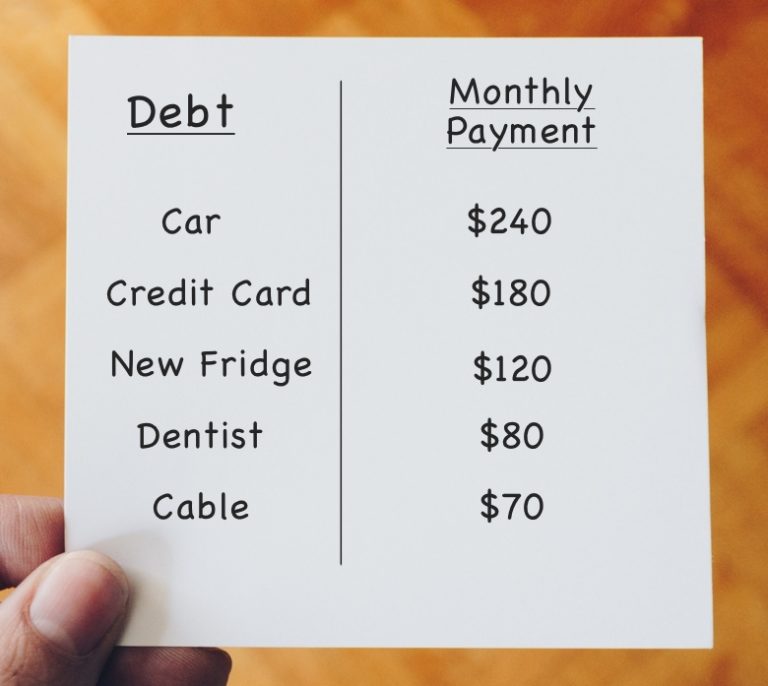

In some cases, student debt holds debtors back from being able to move forward financially. In the worst-case student debt scenarios, these loans create tremendous financial hardship. However, there is relief available from this hardship. Federal student loan debt is not guaranteed to be discharged by the court when an individual declares bankruptcy. Nonetheless, it is possible, but it takes specific extra steps.

Adversary Proceeding

One must start a second bankruptcy process known as a student loan adversary proceeding to have student debt discharged in bankruptcy. Specifically, a student loan adversary proceeding is a lawsuit initiated by a borrower who aims to eliminate their debt due to the significant undue hardship it imposes on them. The majority of courts in the United States have adopted the Brunner test. The test is a standard that requires debtors to prove undue hardship. For example, the borrower must show that they’ve made efforts to pay the loan but cannot maintain a minimal standard of living by doing so. Furthermore, they must show the court that their financial situation is not expected to improve.

There is a commonly believed myth that student loan debts can never be discharged in bankruptcy. For this reason, most individuals declaring bankruptcy do not initiate the next step of an adversary proceeding. They never get the chance to prove that their student loans are causing undue hardship. Only a small percentage of student loan borrowers attempt to discharge their debt. However, 4 out of 10 individuals who do take the next step end up having their student loans discharged.

If you carry student loans that add to the financial hardship in your life, it is worth taking the extra step of an adversary proceeding. Our expert attorneys can provide you with guidance every step of the way and ensure you have the best chance of full discharge, default judgment, or settlement. Contact us today to learn more.