An Upswing of Bankruptcies During Tax Season

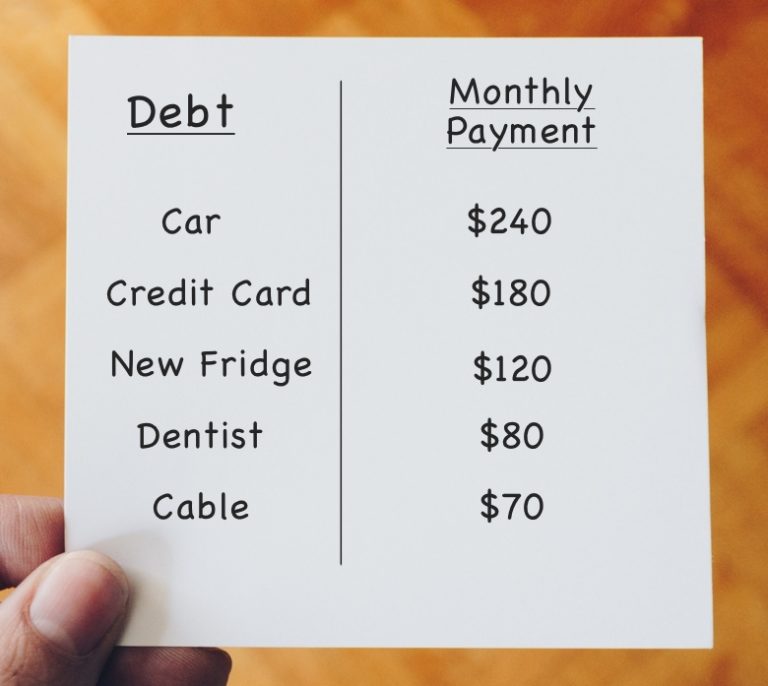

With tax season comes an upswing of bankruptcies. This upward trend may be because federal or state taxes owed, on top of other extensive debt, have become too much for many individuals. Or perhaps the reasoning behind this upswing is that tax season forces many people to look more closely at their financial situation. This closer look may make the decision to file for bankruptcy more prominent during this part of the year. No matter what the case is, filing for bankruptcy is complicated, and navigating taxes during this sensitive time adds a layer of complexity.

How Bankruptcy Impacts Paying Back Taxes

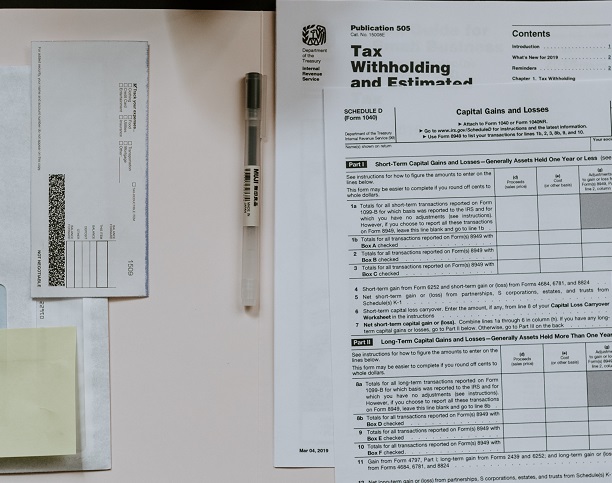

Filing bankruptcy is a potential option to have past-due federal taxes eliminated. However, bankruptcy does not terminate fraud penalties or payroll taxes. Furthermore, the tax debt must be at least three years old. If the IRS does not discharge personal liability for tax debts exceeding three years, bankruptcy may extend an individual’s time to pay the remaining tax liabilities.

Filing for Bankruptcy During Tax Season

During a bankruptcy, it’s essential to file the required tax returns. Failing to do so may mean your case is dismissed. Further, taxpayers in bankruptcy should try their best to pay all current taxes as they come due. The IRS must be notified about a tax payer’s bankruptcy. If the IRS was listed as a creditor in bankruptcy then they will receive notice. A bankruptcy attorney can help you ensure the IRS is notified.

The IRS also requires any forgiven, canceled, or discharged debt as taxable income. Therefore, it must be reported on a return via Cancellation of Debt form 1099-C. The creditor or lender that has canceled the debt should provide a copy of the document.

Filing for bankruptcy can be a complex and challenging process, especially when dealing with it during tax season. Having a bankruptcy attorney prevents mistakes that could harm your case. Moreover, an experienced bankruptcy attorney ensures exemptions are maximized and as many assets are protected as can be.

Contact The Law Offices of Ronald I. Chorches to help you get your finances back on track today.