Foreclosure on the Rise in New Haven, Connecticut

Foreclosure is the legal process by which a mortgage lender takes possession of a property when a homeowner fails to make their mortgage payments. The lender typically uses it as a remedy to recover the money owed on the mortgage loan when the borrower defaults on their payments. Unfortunately, foreclosure is rising in many US cities, including New Haven, Connecticut.

Foreclosure on the Rise

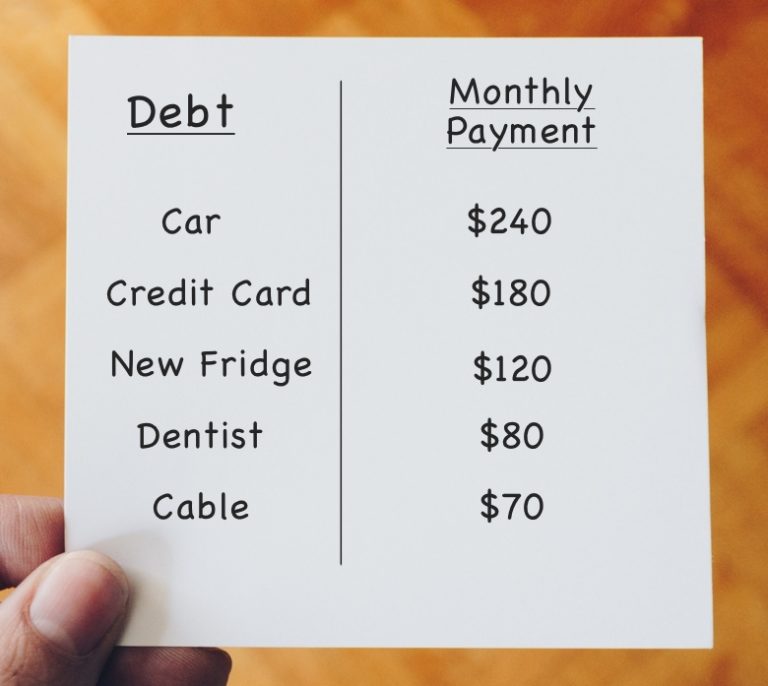

Connecticut, like many other states, implemented measures to protect homeowners from foreclosure during the COVID-19 pandemic. After the moratorium on foreclosures was lifted, there was an influx of foreclosure filings. The uptick was caused by mortgage lenders catching up to homeowners who fell behind on their payments. Moreover, since then, the cost of living has continued to climb. The effects of inflation on daily expenses, such as food costs, have made money tight for many New Haven, CT families. Consequently, some have struggled to pay the mortgage.

There has also been a significant upswing in home values throughout Connecticut, which is generally seen as a positive trend for homeowners. However, for some individuals, the challenge lies in managing their heightened property tax assessments. According to ATTOM, Connecticut has some of the nation’s highest effective property tax rates at 1.57 percent, just behind New Jersey and Illinois.

Preventing Foreclosure

During financial difficulties, it’s essential to make contact with the mortgage lender. Homeowners should proactively communicate with their lenders when they encounter financial problems to explore options for avoiding foreclosure. Early communication and cooperation are key factors in finding a solution that benefits both the homeowner and the lender. While a lender may not be inclined to modify monthly payments, they can provide assistance and alternatives to aid a borrower with getting up to date on mortgage payments.

Lawyers can also play a crucial role in helping individuals facing foreclosure by providing legal advice, representation, and assistance. Attorneys can negotiate with mortgage lenders on behalf of homeowners to investigate alternatives for preventing foreclosure—for example, loan modifications, forbearance agreements, or customized repayment plans. Lawyers frequently utilize their legal expertise and adept negotiation abilities to attain more advantageous terms on behalf of their clients.

The possibility of losing a home can be challenging to come to terms with. For some, there may be plausible options for preventing the foreclosure process. A Connecticut foreclosure lawyer from The Law Offices of Ronald l. Chorches will help. Schedule your consultation today.