The Impact of Holiday Debt on Financial Well-Being: When to Seek Advice From an Attorney

The holiday season often brings warmth, joy, and cherished moments. However, amidst the celebrations, it’s easy to get caught up in the allure of gift-giving, parties, and the spirit of generosity. For many, this cheerful time can also bring an unexpected and challenging aftermath: holiday debt.

Holiday Overspending That Leads to Financial Hardship

Many people overspend during the holiday season. Typically, it comes from a good place. Most holiday overspenders desire to create joyous experiences for loved ones, but their good intentions lead to extravagant spending on gifts and festivities. Unfortunately, holiday overspending can create a domino effect of financial challenges. For example, high-interest debt can quickly accumulate, compounding the original debt and making it much harder to pay off.

Post-Holiday Debt Recovery Strategies

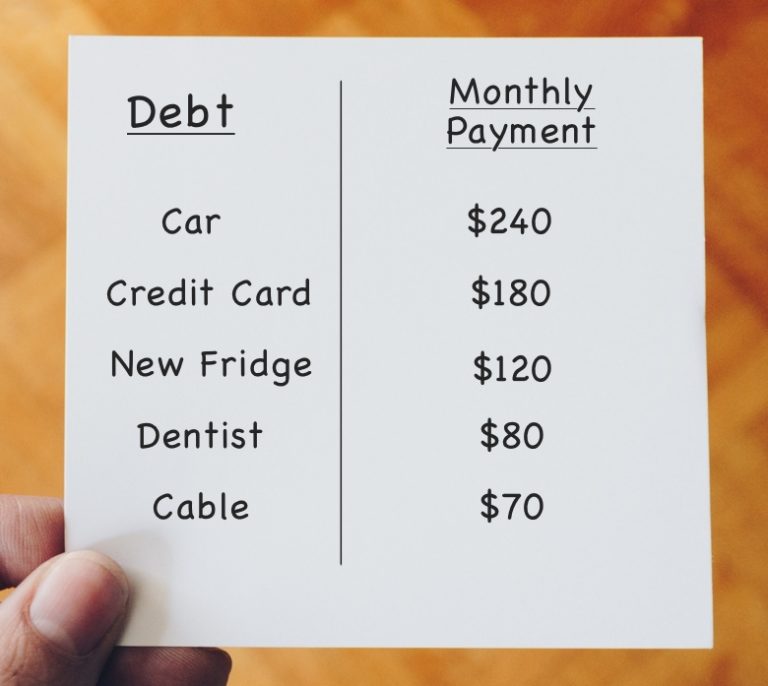

Start by gathering all your post-holiday debts. List them out, noting interest rates and payment due dates. Then, prioritize high-interest debts or those with impending due dates first to avoid penalties. Next, review your budget to redirect more funds towards repaying debts. You can temporarily cut back on non-essential expenses to create extra money for paying off debts. For instance, think about shifting funds from leisure or luxury spending towards debt repayment. Moreover, you can explore ways to generate extra income, like selling unused items or taking on part-time work. The additional funds can accelerate debt repayment. However, if the debt seems overwhelming and unmanageable, seeking legal advice from a skilled bankruptcy attorney might be necessary.

When to Seek Legal Advice

When holiday overspending leads to overwhelming financial hardship, it’s time to work with an attorney to regain financial stability. Some signs it’s time to seek legal advice include consistently missed payments on credit cards, frequent calls or notices from creditors regarding overdue payments, and threats of legal action, such as lawsuits or wage garnishment. Furthermore, struggling to cover essential expenses like rent, utilities, or groceries due to holiday debt could signify that legal intervention, such as bankruptcy evaluation, is necessary. Attorneys offer guidance in handling debt, exploring bankruptcy, engaging in negotiations with creditors, and understanding one’s rights and responsibilities to navigate financial difficulties caused by holiday overspending.

Remember, recovering from post-holiday debt takes time and commitment. It’s about making gradual progress and staying consistent with repayment efforts. If needed, our team of financial experts is here to support and guide you through this journey toward financial well-being. Contact us today to schedule your free consultation.